Share this

7 Best AI Tools for Mortgage Lead Generation for 2026: Features, Pricing, Use Cases

by MagicBlocks Team on Feb 13, 2026 12:58:13 AM

Mortgage lead generation in 2026 isn't about buying lists or cold calling — it's about using AI to identify intent, automate conversations, and convert borrowers faster.

The mortgage industry is experiencing a fundamental shift. According to recent McKinsey research on mortgage market strategies, lenders face an urgent need to upgrade their platforms and leverage data-driven tools to maintain competitive advantage as customer behaviors continue evolving toward digital-first experiences.

Meanwhile, S&P Global's analysis of AI adoption in mortgage origination reveals that automated, intelligent systems are becoming critical infrastructure for lenders seeking to streamline operations and improve conversion rates.

The reality? 78% of borrowers go with the first loan officer who responds to their inquiry. Speed matters. Consistency matters. And most importantly, the quality of that first conversation matters more than ever.

Here are the 7 best AI platforms transforming how mortgage professionals generate and close leads in 2026.

Top AI Tools for Generating Mortgage Leads

Quick Overview:

- MagicBlocks.ai – Best for capturing and qualifying mortgage leads with CDP-native memory

- Convin.ai – Best for improving sales call performance and compliance

- LoanOfficer.ai – Best for automated follow-up and lead nurturing

- Conduit.ai – Best for scaling outbound campaigns across channels

- AI Prospector – Best for predictive borrower targeting and refinance leads

- LanderLab – Best for increasing ad conversion rates with optimized landing pages

- Voiceflow – Best for building mortgage chatbots and voice agents

Why AI Is Transforming Mortgage Lead Generation

How does AI improve mortgage marketing?

The mortgage industry has reached a tipping point. While traditional prospecting methods convert only 3% of leads, AI-powered systems are pushing conversion rates into the 15-20% range by fundamentally changing how lenders identify, qualify, and nurture leads.

Here's what's actually happening:

Predictive analytics identifies ready-to-apply borrowers by analyzing hundreds of data points — behavioral triggers like checking home values, life event indicators, financial readiness signals, and timing predictors based on historical patterns. AI mortgage lead technology goes infinitely deeper than basic demographic filters.

Behavioral tracking personalizes outreach across every touchpoint. Instead of sending the same generic newsletter to your entire database, AI segments prospects based on individual behavior and preferences, automatically delivering targeted content that moves each lead closer to conversion.

Automation reduces manual pipeline tasks that used to consume hours every day. From document collection to appointment scheduling to follow-up sequences, AI handles the heavy lifting while loan officers focus on relationship building and closing deals.

Smart retargeting increases conversion rates by keeping your brand in front of prospects at exactly the right moments. AI identifies when each prospect is most likely to engage and automatically schedules outreach for maximum impact.

The tools below represent the cutting edge of mortgage lead generation technology. Each platform offers distinct advantages depending on your business model, team size, and specific needs.

Top Rated AI Tools for Mortgage Lead Generation for 2026

1. MagicBlocks.ai – The All-in-One AI Growth Engine

Best For: Best for capturing and qualifying mortgage leads

Core Capabilities:

MagicBlocks is an autonomous relationship sales platform built specifically to sell, qualify, and nurture leads using proven sales psychology at scale.

- CDP-native memory engine that actually remembers every borrower's history, preferences, and constraints across all channels

- HAPPA sales framework (Hook → Align → Personalize → Pitch → Action) developed from $200M+ in lead generation experience

- Multi-channel engagement across web chat, SMS, and soon email, social DMs and voice.

- Automated qualification flows that pre-screen borrowers 24/7

- CRM & ad platform integrations including GoHighLevel, HubSpot, and Zapier

- Industry-specific templates for mortgage brokers, lenders, and agencies

Why It Stands Out:

Most AI tools are stateless — they treat every interaction like Day 1. MagicBlocks centralizes targeting → qualification → nurturing → conversion into one AI engine with persistent memory. Your AI agent doesn't just respond; it remembers, adapts, and sells using codified playbooks that have generated over $200M in leads.

The platform uses context-aware hooks that feel impossibly personal: "Hey Sarah, back for refinancing options? I've got some new rates you might like." It reads visitor signals — location, page history, previous visits — and crafts opening lines that convert.

Key Features:

- Proactive Chat: AI initiates personalized first-contact messages

- Lead Handoff: Seamless transfer to CRM when qualified

- Guardian Monitoring: Built-in compliance and safety features

- Functions & Tasks: Advanced automation for complex workflows

- Dynamic Tokens: Inject live data into every message

- Knowledge Collections: Train your AI on unlimited company data

Pricing:

- Free Plan: 200 AI messages, 1 agent, chat-only integration

- Standard: $3,000 AI messages/month at $0.06 overage - All channels, widget whitelabel

- Plus: $10,000 messages/month at $0.04 overage - Tasks, Guardian Monitor, SOC2 compliance

- Pro: $80,000 messages/month at $0.02 overage - Enterprise features, advanced analytics

All plans include Directors (natural language automation), Custom Knowledge, Lead Handoff, Sessions tracking, Internal AI CRM, and Proactive Chat.

Pros:

- Persistent memory across all channels means borrowers never repeat themselves

- HAPPA framework proven with $200M+ in lead generation results

- Industry-specific templates get you live in minutes

- Full compliance monitoring built-in (Guardrails feature)

- Scales from solo agents to enterprise teams seamlessly

- Proactive chat initiates conversations (not just reactive)

- All-channel integration (API)

Cons:

- Free plan limited to 200 messages (though perfect for testing)

- Advanced features require Plus or Pro plans for high-volume teams

- Initial setup requires some time to train AI on your specific knowledge base

Ideal User:

Lender companies, mortgage lead agencies, loan officers and broker teams who want scalable automation with measurable ROI and proven sales methodology baked into every conversation.

Use Case:

A mortgage broker implements MagicBlocks and sees 7x more applications (real Beeline result). The AI agent qualifies leads 24/7, books appointments directly into calendars, handles objections using the HAPPA framework, and seamlessly hands off qualified prospects to loan officers — all while maintaining context across every interaction.

2. Convin.ai – AI Conversation Intelligence

Best For: Improving Sales Call Performance

Core Capabilities:

Convin transforms how mortgage teams analyze, coach, and optimize their sales conversations through AI-powered call analysis.

- AI call analysis and transcription across 100% of conversations

- Conversation scoring to identify what's working

- Compliance monitoring for TCPA, Fair Housing Act, and ECOA regulations

- Performance coaching insights based on successful patterns

- Automated quality assurance to meet lending requirements

- Real-Time Agent Assist with live prompts during calls

- Voice of Customer insights for understanding borrower needs

Impact:

Better borrower conversations → higher trust → improved close rates. Convin's data shows mortgage teams can increase collection rates by 17% and achieve 21% higher sales conversions by replicating what top performers do.

Key Features:

- Automated call quality audits (100% coverage vs. manual 1-2%)

- Sentiment analysis to understand borrower emotions

- Topic detection for compliance-critical conversations

- Performance metrics tracking (AHT, CSAT, conversion rates)

- Personalized coaching based on actual call patterns

Pricing:

- Free Plan: Limited features for testing

- Enterprise Plan: Custom pricing based on call volume and team size

- Typical investment ranges from $800/month for small teams to $8,000+ for mid-size lenders

Pros:

- 100% call coverage vs. manual 1-2% auditing

- Real-time agent assist during live calls

- Proven results: 17% higher collection rates, 21% higher sales conversions

- Built specifically for financial services compliance

- Automated quality assurance saves hours weekly

- Sentiment analysis reveals customer emotions

Cons:

- Primarily focused on call analysis, not lead generation

- Custom pricing can be expensive for smaller teams

- Limited features in free plan

- Requires call volume to justify investment

Ideal User:

Mortgage call centers, lending teams, and brokerages focused on coaching loan officers to handle objections, maintain compliance, and close more deals through improved conversation quality.

Use Case:

A regional credit union with 100 employees uses Convin to handle loan applications, payment processing, collections calls, and member service inquiries across phone, chat, and SMS — integrated with their core banking platform and loan origination system.

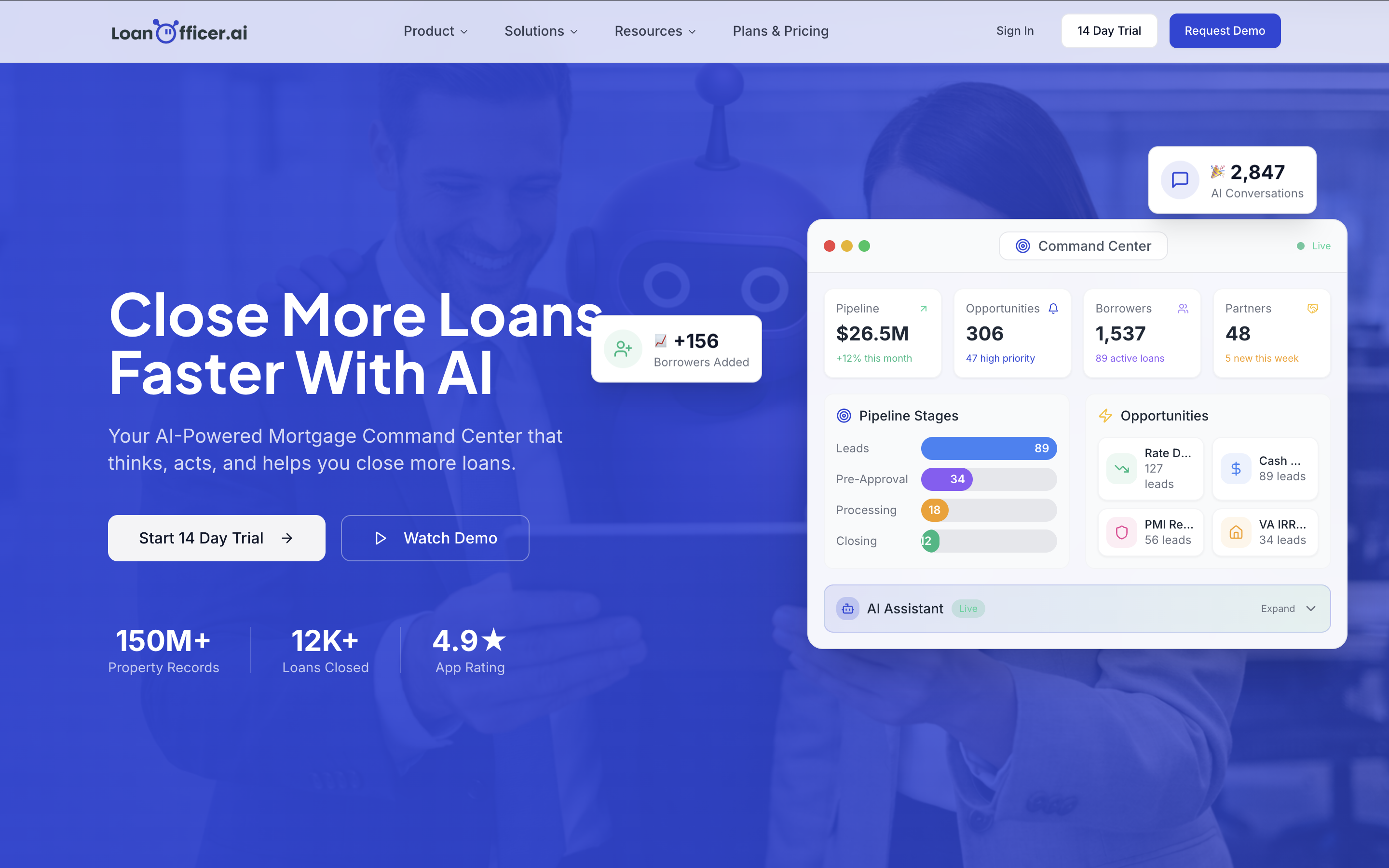

3. LoanOfficer.ai – AI Assistant for Loan Officers

Best For: Automated Follow-Up & Lead Nurturing

Core Capabilities:

LoanOfficer.ai positions itself as your AI-powered mortgage CRM that thinks, acts, and helps you close more deals.

- Sub-60-second response times to every lead, even while you sleep

- Automated drip campaigns personalized to borrower behavior

- Smart appointment reminders and calendar booking

- Lead qualification flows with underwriting-grade logic

- CRM syncing with major LOS systems via Zapier

- Rate watch monitoring for refinance opportunities

- Custom-trained AI tailored to your voice and specialties

- Mortgage trigger alerts for listing changes

Impact:

Reduces response time and increases application completion. Research shows 78% of borrowers choose the first lender who responds — LoanOfficer.ai ensures you're always first.

Key Features:

- AI qualifies leads 24/7 using borrower psychology and mortgage guidelines

- Branded websites built for lead capture

- Built-in dialer for staying connected

- Client-ready visual calculators (no spreadsheets)

- Automated market updates to database

- Application guidance with AI-powered conversations

Pricing:

- One-time onboarding: $299 (includes complete account setup, full integrations, white-glove experience)

- Monthly subscription: Plans include AI Assistant, mortgage CRM, marketing suite, rate watch, and automation tools

- Each user seat includes unlimited calls, 1,000 SMS segments, and 5,000 emails per month

Pros:

- Sub-60-second response times ensure you're first to respond

- All-in-one CRM eliminates need for multiple tools

- Custom-trained on your specific products and voice

- Rate watch monitors entire database for refinance opportunities

- White-glove onboarding included

- Branded websites included with subscription

Cons:

- $299 onboarding fee required (though comprehensive setup included)

- Must adopt their entire CRM system

- Limited customization compared to standalone solutions

- Integration limited to Zapier connections

Ideal User:

Solo loan officers and small mortgage teams who need an all-in-one CRM with AI assistance to automate follow-up while maintaining a personal touch with borrowers.

Use Case:

An independent loan officer sets up LoanOfficer.ai and immediately begins responding to leads within 60 seconds. The AI pre-qualifies borrowers, books appointments, sends rate alerts when opportunities arise, and keeps the entire database engaged with personalized market updates — freeing the loan officer to focus exclusively on closing deals.

4. Conduit.ai – AI-Powered Outreach & Appointment Booking

Best For: Scaling Outbound Campaigns

Core Capabilities:

Conduit builds conversational AI workflows designed specifically for customer-facing businesses in financial services.

- AI-driven outbound messaging across voice, SMS, email, and chat

- Appointment scheduling automation integrated with calendars

- Multi-channel engagement from unified inbox

- Smart response handling that knows when to escalate

- Native CRM connections (Salesforce, HubSpot, and more)

- Workflow automation for lead qualification and follow-ups

- Compliance features for financial services regulations

Impact:

Higher contact rates without expanding sales teams. Conduit automates 65% of messages for companies like BlueGems, allowing teams to focus exclusively on revenue-generating activities.

Key Features:

- Voice AI for inbound and outbound calls

- Conversational AI across all communication channels

- Real-time call transcription and analysis

- Custom workflow builder for complex journeys

- Integration with mortgage platforms (Encompass, Blend, Optimal Blue)

- SOC 2 Type II compliance

Pricing:

- Credit-based model: Conduit Credits power all automation

- Small mortgage brokers: ~$800/month for basic automation

- Mid-size lenders: $2,000-$15,000/month for advanced features

- Enterprise lenders: $15,000-$100,000+ for complete solutions

- Additional credits can be purchased anytime

Pros:

- True multi-channel automation (voice, SMS, email, chat)

- Unified inbox centralizes all customer interactions

- Native integrations with major mortgage platforms

- SOC 2 Type II compliant

- Proven to automate 65% of messages for customers

- Real-time conversation management

Cons:

- Credit-based pricing can be confusing to budget

- Higher starting cost (~$800/month minimum)

- Requires technical setup for optimal workflows

- Limited mortgage-specific templates compared to specialized tools

Ideal User:

Lenders and mortgage teams focused on high-volume outbound campaigns who need to qualify leads, schedule appointments, and manage conversations across multiple channels without dramatically expanding headcount.

Use Case:

A mortgage lender uses Conduit to automate lead qualification and screening 24/7. When new applications come in, the AI agent handles initial conversations, pre-screens applicants, books consultations with loan officers, and tracks every interaction in Salesforce — all while the team sleeps.

5. AI Prospector – Predictive Borrower Targeting

Best For: Finding Refinance & High-Intent Leads

Core Capabilities:

AI Prospector is a fully managed multi-channel AI solution focused on qualifying, nurturing, and booking appointments with high-intent mortgage leads.

- Predictive data modeling to identify ready-to-refinance homeowners

- Borrower intent signals based on behavioral triggers

- Refinance targeting with equity analysis

- Smart segmentation by life events and financial readiness

- Multi-channel outreach (email, LinkedIn, phone)

- Managed service model with dedicated virtual assistants

- Zero domain risk (they use their own assistants)

Impact:

Improves lead quality before marketing spend increases. Industry research shows AI-powered lead scoring can improve conversion rates by up to 300% by ensuring you're talking to the right person at the right time with the right message.

Key Features:

- Fully managed appointment setting

- Loan officer and referral partner recruiting

- Industry-leading engagement rates driven by true AI

- Virtual assistant team handling time-consuming processes

- Turn-key solution with everything needed to start immediately

Pricing:

Custom pricing based on campaign scope and lead volume. AI Prospector operates on a managed service model where they provide both the technology and the human support team.

Pros:

- Fully managed service (hands-off for clients)

- No risk to your domain or LinkedIn accounts

- Virtual assistant team included

- Industry-leading engagement rates

- Predictive modeling identifies best refinance opportunities

- Multi-channel outreach strategy

Cons:

- Custom pricing with no transparent rates published

- Less control over messaging and process

- Managed service model may not suit all business styles

- Limited to lead generation and appointment setting

Ideal User:

Mortgage teams and brokerages looking for a hands-off solution to fill their pipeline with qualified refinance leads and referral partner connections without managing the outreach themselves.

Use Case:

A mortgage company struggling to identify refinance opportunities implements AI Prospector. The AI analyzes their database, identifies homeowners with 10+ years of ownership approaching retirement age with significant equity, and launches personalized multi-channel campaigns — booking qualified appointments directly into loan officers' calendars.

6. LanderLab – AI-Optimized Mortgage Landing Pages

Best For: Increasing Ad Conversion Rates

Core Capabilities:

LanderLab focuses exclusively on creating high-converting landing pages and quiz funnels optimized for lead generation.

- AI-designed landing pages from single prompts

- 120+ pre-built templates industry-specific

- A/B testing tools for continuous optimization

- Conversion optimization features (fast loading, mobile responsive)

- Quiz funnel builder for lead qualification

- Built-in tracking and analytics

- CRM integrations for seamless lead flow

Impact:

Turns paid traffic into completed applications. LanderLab pages load in under 2 seconds globally via Cloudflare CDN and are built specifically to convert mortgage shoppers into qualified leads.

Key Features:

- Drag-and-drop editor with no coding required

- AI Quiz Funnels that automatically structure qualification logic

- Import pages directly from URLs

- Advanced code editor for developers

- Multi-workspace collaboration with permissions

- Webhook integrations with major CRMs

- SEO optimization built-in

Pricing:

- Starter: $49/month (basic features)

- Pro: $69/month (A/B testing, advanced features)

- Launch: $89/month (100,000 monthly visits, 50 published pages, AI tools)

- Master: $109/month (advanced tracking, unlimited features)

All plans include 7-day free trial. Higher tiers offer more monthly visitors, published pages, custom domains, and advanced optimization tools.

Pros:

- AI generates complete landing pages and quiz funnels from prompts

- Loads in under 2 seconds globally via Cloudflare CDN

- 120+ industry-specific templates included

- A/B testing built-in from Starter plan

- No coding required with drag-and-drop builder

- 7-day free trial available

Cons:

- Focused solely on landing pages (not full marketing automation)

- Requires separate tools for email/SMS follow-up

- Limited CRM features compared to all-in-one platforms

- Advanced tracking requires higher-tier plans

Ideal User:

Mortgage marketers, affiliates, and teams running paid advertising campaigns who need high-converting landing pages that can be deployed quickly and tested continuously for maximum ROI.

Use Case:

A mortgage broker running Facebook ads for refinance leads uses LanderLab's AI to generate a quiz funnel in minutes. Prospects answer qualification questions (credit score range, home value, current rate), receive personalized results, and can book appointments — all on a fast-loading, mobile-optimized page that converts at 3x their previous rate.

7. Voiceflow – Conversational AI & Voice Bots

Best For: Building Mortgage Chatbots & Voice Agents

Core Capabilities:

Voiceflow is a no-code platform for building AI chat and voice agents through a drag-and-drop visual interface.

- Custom chatbot flows with visual builder

- Voice AI call automation for inbound/outbound

- Pre-qualification scripts for borrower screening

- Integration with CRMs and mortgage platforms

- Knowledge base training on your documents

- Multi-agent management from one workspace

- LLM integrations (GPT-4, Claude, and others)

Impact:

Captures leads 24/7 and automates initial borrower screening. Voiceflow agents can handle pre-qualification, rate quotes, document collection, appointment scheduling, application status, and refinancing analysis.

Key Features:

- No-code flow builder for conversational design

- AI agents with functions, paths, and instructions

- Intents and entities for understanding user input

- Knowledge base sources per agent (up to 10,000+)

- Voice and telephony integration via Twilio

- Analytics and conversation tracking

- Multi-language support

Pricing:

- Starter (Free): 50 knowledge base sources, 2 agents, 100 monthly AI tokens

- Pro: $60/month per editor (3,000 knowledge sources, 20 agents, 10,000 tokens)

- Business: $150/month per editor (10,000 knowledge sources, unlimited agents, 30,000 tokens)

- Enterprise: Custom pricing (unlimited features, SSO, private cloud hosting)

Additional editors cost $50/month each. Credit-based system for AI usage.

Pros:

- Visual no-code builder makes complex flows accessible

- Free plan available for testing

- Supports both chat and voice channels

- Integrates with major LLMs (GPT-4, Claude)

- Multi-agent management from single workspace

- Extensive customization options for developers

Cons:

- Credit-based pricing gets expensive at scale

- Voice functionality requires external telephony setup (Twilio)

- Limited live chat support

- Latency issues reported for voice applications (600-700ms)

- Per-editor pricing inflates costs for teams

- Better for chatbot design than production voice deployment

Ideal User:

Mortgage brokers and lenders who want to build custom conversational experiences for website visitors and phone callers without hiring developers, with the flexibility to design complex flows tailored to their specific qualification process.

Use Case:

A mortgage brokerage builds a Voiceflow agent that handles incoming calls 24/7. When prospects call, the AI collects essential information (income, credit score range, desired loan amount), provides instant rate quotes, explains loan options, and either books appointments with loan officers or transfers high-intent callers immediately — all while maintaining conversation history across channels.

Comparison Table

|

Tool |

Best For |

Key Strength |

Starting Price |

Integration Capability |

|

MagicBlocks.ai |

Best for capturing and qualifying mortgage leads |

CDP-native memory + HAPPA sales framework |

Free (200 messages) |

GoHighLevel, HubSpot, Zapier |

|

Convin.ai |

Call performance |

100% call analysis + compliance monitoring |

Free trial, Custom pricing |

Major LOS systems, CRMs |

|

LoanOfficer.ai |

Automated follow-up |

Sub-60-second response times |

$299 setup + subscription |

Most LOS via Zapier |

|

Conduit.ai |

Outbound scaling |

Multi-channel AI automation |

~$800/month |

Salesforce, Encompass, Blend |

|

AI Prospector |

Predictive targeting |

Managed service model |

Custom pricing |

Email, LinkedIn, phone |

|

LanderLab |

Landing page conversion |

AI-built pages in minutes |

$49/month |

Major CRMs via webhooks |

|

Voiceflow |

Chatbot & voice agents |

Visual no-code builder |

Free (limited), $60/month |

Twilio, CRMs, custom APIs |

How to Choose the Right AI Tool for Your Mortgage Business

Decision Framework

Need full-funnel automation with persistent memory? → MagicBlocks gives you the only CDP-native AI sales platform with proven sales psychology baked in.

Need better sales call performance and compliance? → Convin.ai provides conversation intelligence and coaching insights across 100% of calls.

Need automated follow-up that feels personal? → LoanOfficer.ai responds within 60 seconds and nurtures leads using mortgage-specific logic.

Need outbound scaling across channels? → Conduit.ai automates conversations via voice, SMS, email, and chat from unified workflows.

Need smarter targeting of refinance opportunities? → AI Prospector uses predictive models and manages the entire outreach process.

Need landing page conversion optimization? → LanderLab builds and tests pages specifically designed to convert mortgage shoppers.

Need voice/chat automation with custom flows? → Voiceflow gives you visual builder flexibility for complex conversational experiences.

Cost and ROI Benchmarks for AI-Powered Mortgage Lead Generation

When evaluating AI tools for mortgage lead generation, consider these ROI factors:

Speed to Lead: Industry data shows 78% of borrowers choose the first responder. Tools that enable sub-60-second response times (like MagicBlocks and LoanOfficer.ai) dramatically increase conversion rates from initial inquiry to qualified application.

Conversion Rate Improvement: Traditional prospecting converts ~3% of leads. AI-powered platforms push this to 15-20% by improving qualification accuracy, personalization, and follow-up consistency.

Cost Per Lead: Exclusive mortgage leads typically cost $25-$80 each. AI automation can reduce effective CPL by 40-60% through better qualification and higher conversion rates on existing traffic.

Application Completion: The average mortgage lead requires 3-5 follow-up touchpoints. AI automation ensures no lead falls through the cracks, increasing application completion rates by 25-30%.

Lead Quality: Predictive analytics and behavioral tracking identify high-intent borrowers. Tools like AI Prospector and MagicBlocks can improve lead quality scores by 2-3x through smarter targeting.

Scalability: The best AI platforms allow you to handle 5-10x more leads without proportionally expanding your team, dramatically improving per-agent productivity and overall ROI.

Frequently Asked Questions

How does AI improve lead conversion rates for mortgage brokers compared to manual outreach?

AI improves conversion rates by ensuring instant response times (critical since 78% of borrowers choose the first responder), maintaining consistent follow-up across days or weeks, personalizing every interaction based on borrower behavior, and qualifying leads more accurately using data-driven models. While manual outreach might reach 20-30% of leads with generic messaging, AI platforms like MagicBlocks engage 100% of prospects with personalized, timely communication that addresses their specific needs and objections.

How do AI mortgage tools ensure compliance with Fair Housing Act and ECOA regulations?

Leading AI platforms include built-in compliance guardrails. MagicBlocks uses its Guardian Monitor feature to ensure all conversations meet industry standards. Convin.ai provides 100% compliance monitoring with automated quality assurance and audit trails for regulatory reporting. These systems flag potential compliance issues in real-time, maintain secure audit logs, and ensure all automated communications include proper consent documentation required by TCPA regulations.

What are the most effective AI-driven platforms for mortgage loan origination leads?

MagicBlocks.ai stands out as the most comprehensive platform because it combines predictive lead scoring, automated qualification, multi-channel nurturing, and CRM integration into a single system with persistent memory. Unlike stateless chatbots, MagicBlocks remembers every borrower interaction and sells using the proven HAPPA framework developed from $200M+ in lead generation. For companies focused specifically on call performance, Convin.ai provides the deepest conversation intelligence. For landing page optimization, LanderLab delivers the fastest time-to-market with AI-generated pages.

Can AI reduce cost per mortgage lead?

Absolutely. AI reduces cost per lead through multiple mechanisms: (1) Higher conversion rates on existing traffic mean you acquire more customers from the same ad spend, (2) Automated qualification prevents wasted time on unqualified prospects, (3) 24/7 engagement captures leads outside business hours that would otherwise be lost, (4) Behavioral targeting identifies high-intent borrowers before competitors, reducing competition and cost, (5) Improved landing page conversion (via tools like LanderLab) means lower acquisition costs per application. Most mortgage teams see 40-60% reduction in effective CPL within 3-6 months of implementing AI automation.

Which AI software helps mortgage lenders generate high-quality leads?

MagicBlocks.ai is the top choice for mortgage lenders focused on lead quality and conversion. The platform's CDP-native memory engine ensures every conversation builds on previous interactions, creating a relationship-based approach that resonates with borrowers. The built-in HAPPA sales framework (Hook → Align → Personalize → Pitch → Action) has been proven across $200M+ in lead generation and consistently delivers higher-quality applications. MagicBlocks integrates seamlessly with GoHighLevel and other mortgage-focused CRMs, provides industry-specific templates for lenders, and includes Guardian compliance monitoring — making it the most comprehensive AI solution for mortgage lead generation.

What KPIs should mortgage teams track when using AI-driven lead generation?

Track these critical metrics: Response Time (should be under 60 seconds for optimal conversion), Contact Rate (20-40% is good depending on lead quality), Qualification Rate (percentage of contacts that become qualified leads), Application Rate (15-30% for high-quality leads), Pull-Through Rate (applications that become closed loans, industry average 65-75%), Cost Per Lead vs. Cost Per Application vs. Cost Per Closed Loan (track the full funnel), Channel Performance (which lead sources convert best), AI Engagement Metrics (conversation completion rates, objection handling success), Lifetime Value (borrowers who refinance or refer generate 3-5x more value), and Compliance Score (ensure 100% of AI conversations meet regulatory standards).

Conclusion: The Future of Mortgage Lead Generation Is Already Here

The mortgage industry has reached an inflection point. Borrowers expect instant responses, personalized experiences, and frictionless digital journeys. Traditional approaches simply can't compete at scale.

The tools we've covered represent different approaches to the same fundamental challenge: how do you engage more prospects, qualify them faster, nurture them consistently, and convert them at higher rates — all without proportionally expanding your team?

For teams ready to transform their entire lead generation funnel, MagicBlocks.ai offers the most comprehensive solution. It's the only platform that combines persistent memory, proven sales methodology, and multi-channel automation into a single system designed specifically to sell mortgage products.

For teams focused on improving existing sales performance, Convin.ai provides unmatched conversation intelligence and coaching capabilities.

For solo loan officers and small teams, LoanOfficer.ai delivers an all-in-one CRM with AI that ensures you're always first to respond.

For high-volume outbound operations, Conduit.ai scales conversations across every channel without expanding headcount.

For landing page optimization, LanderLab turns paid traffic into qualified applications faster than any other platform.

The common thread? Every platform on this list helps mortgage professionals do more with less — capturing leads that would otherwise slip away, nurturing relationships that would otherwise go cold, and converting prospects that would otherwise choose a competitor.

The question isn't whether to adopt AI for mortgage lead generation. The question is which platform aligns best with your specific business model and growth objectives.

Ready to Transform Your Mortgage Lead Generation?

Try MagicBlocks.ai free and experience AI that actually sells. Built for mortgage professionals who want to automate relationship sales at scale.

Start with 200 AI messages free, deploy industry-specific templates in minutes, and watch your conversion rates climb as your AI agent remembers every conversation, handles objections using proven sales frameworks, and books qualified appointments 24/7.

👉 Get started with MagicBlocks and join mortgage teams already seeing 7x more applications.